5 Best Online Tools To Build A Budget Automatically

Ever feel like your money disappears faster than you can track it? You're not the only one who has started the month with the best intentions, only to wonder where all the cash went by the 15th. Manual budgeting can be time-consuming, overwhelming, and let's face it, most of us don't enjoy crunching numbers in a spreadsheet after a long day. That's where automatic budgeting tools come in to save the day. Let's explore some of the top online tools for automatically building a budget.

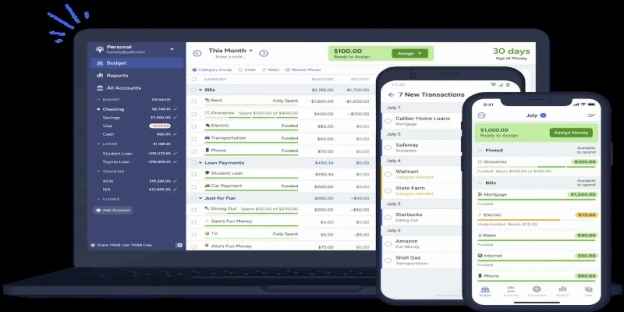

YNAB (You Need A Budget): Built For Goal-Oriented Budgeters

If you're serious about taking control of your money and don't mind getting involved in the setup process, You Need A Budget (YNAB) might be your best ally.

Unlike many budgeting tools that track your expenses, YNAB is built around a proactive philosophy. It helps you give every dollar a job. This means instead of just looking back at what you've spent, you actively assign money to categories in advance, such as rent, groceries, vacations, and more.

The standout feature? YNAB forces you to work only with the money you already have. It encourages living within your means and building a cushion for the future. Over time, the goal is to "age" your money—meaning you spend income that came in over a month ago.

YNAB syncs with your bank and credit card accounts automatically, providing real-time budget updates. It also offers innovative reporting tools and trend analysis, enabling you to identify areas where improvements are being made and where you're falling short.

It’s ideal for:

People who want to be intentional with every dollar

Budgeters working toward specific financial goals

Those who don’t mind a learning curve for long-term payoff

Mint: A Familiar Favourite With Seamless Syncing

Mint has been a go-to budgeting app for years, and it continues to hold up. Owned by Intuit (the makers of TurboTax), it combines budgeting with credit monitoring and financial trend analysis.

The platform pulls in data from your accounts and automatically categorises your transactions. Over time, it learns your habits and becomes more intelligent at recognising recurring payments, splitting bills, and even alerting you to unusual activity.

Where Mint shines is its user interface. Everything is laid out clearly—your monthly budget, your bills, and your financial goals. If you're new to budgeting and want something you can set up in minutes, this is a great starting point.

It's beneficial for:

Beginners who want an overview of their entire financial picture

People with multiple accounts and income streams

Those looking for helpful reminders on bill due dates

Mint also provides you with customised advice based on your spending, nudging you toward saving and offering suggestions for reducing non-essential expenses.

Monarch Money: A Visual, Collaborative Approach To Budgeting

Ever wish your budget didn’t feel like a boring math assignment? Monarch Money understands that. It’s one of the newer tools on the market, but it’s made a big splash with its sleek visuals and user-friendly design.

Monarch stands out because it allows collaborative budgeting. You can invite a partner to your financial dashboard and work on your budget together. This is ideal for couples or families who want to be on the same page financially without constantly texting each other about expenses.

It automatically syncs with your financial accounts and helps you plan everything from daily budgets to long-term goals like buying a home or taking a sabbatical. You can set monthly spending limits, track net worth, and even create detailed reports on progress over time.

Best for:

Couples or families budgeting together

Visual learners who want graphs, charts, and dashboards

People are looking for a balance between automation and customisation

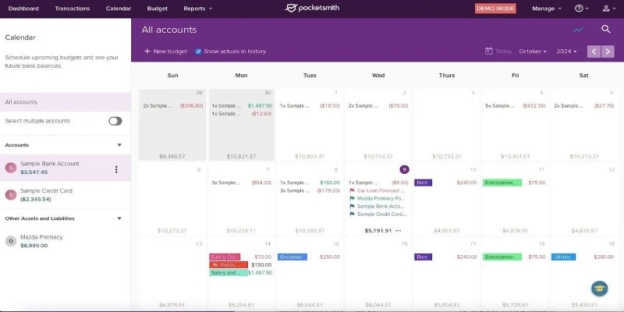

PocketSmith: Your Budget, Reimagined As A Calendar

Want to see where your money is going in the future, not just what you've already spent? PocketSmith might be your tool.

One of the few budgeting apps with a calendar-based forecast, PocketSmith enables you to project your finances weeks, months, or even years in advance. You can model different scenarios (like a job change or car purchase) and see how it impacts your budget over time.

It also provides automatic transaction syncing and categorisation, of course, but its unique value lies in the forward-looking approach.

This tool is perfect if you:

Want to forecast your financial future in a practical, visual way

Like setting "what if" goals to plan for significant life changes

Prefer detailed customisation over plug-and-play apps

Copilot: A Budgeting App For Apple Users With A Modern Feel

If you're an iPhone or Mac user who loves slick design and intuitive tools, Copilot could be the app that finally makes budgeting feel less like a chore. It offers clean visuals, fast syncing, and AI-powered categorisation.

What sets it apart is its seamless integration with Apple's ecosystem. If you use Apple Pay, Apple Card, or even want your budgeting app to feel native to your device, Copilot delivers a seamless experience.

It's also an excellent choice for freelancers or people with irregular income. The app can automatically create monthly budgets based on your average income and expenses, helping you stay on track even if your paychecks vary.

Best for:

Apple users who value modern UI and performance

Freelancers or gig workers with non-traditional income

Budgeters who want a fast, intuitive setup

Do These Tools Replace Financial Advice?

Not quite. While these apps are excellent for tracking your finances and helping you stick to a budget, they don't replace the need for personalised financial guidance, especially when it comes to investments, taxes, or retirement planning. However, they do provide a solid foundation to build upon.

By showing you where your money is going, you're better equipped to make wise decisions and identify when it's time to bring in a professional.

Building Better Money Habits With Less Effort

In the end, automatic budgeting tools do more than help you save a few dollars. They create awareness, reduce money Stress, and set you on a path toward financial clarity. Whether you're looking to break the cycle of overspending or save for your dream trip, there's a tool available to make it easier. Let the tools handle the math. You focus on the goals.